Executive Summary

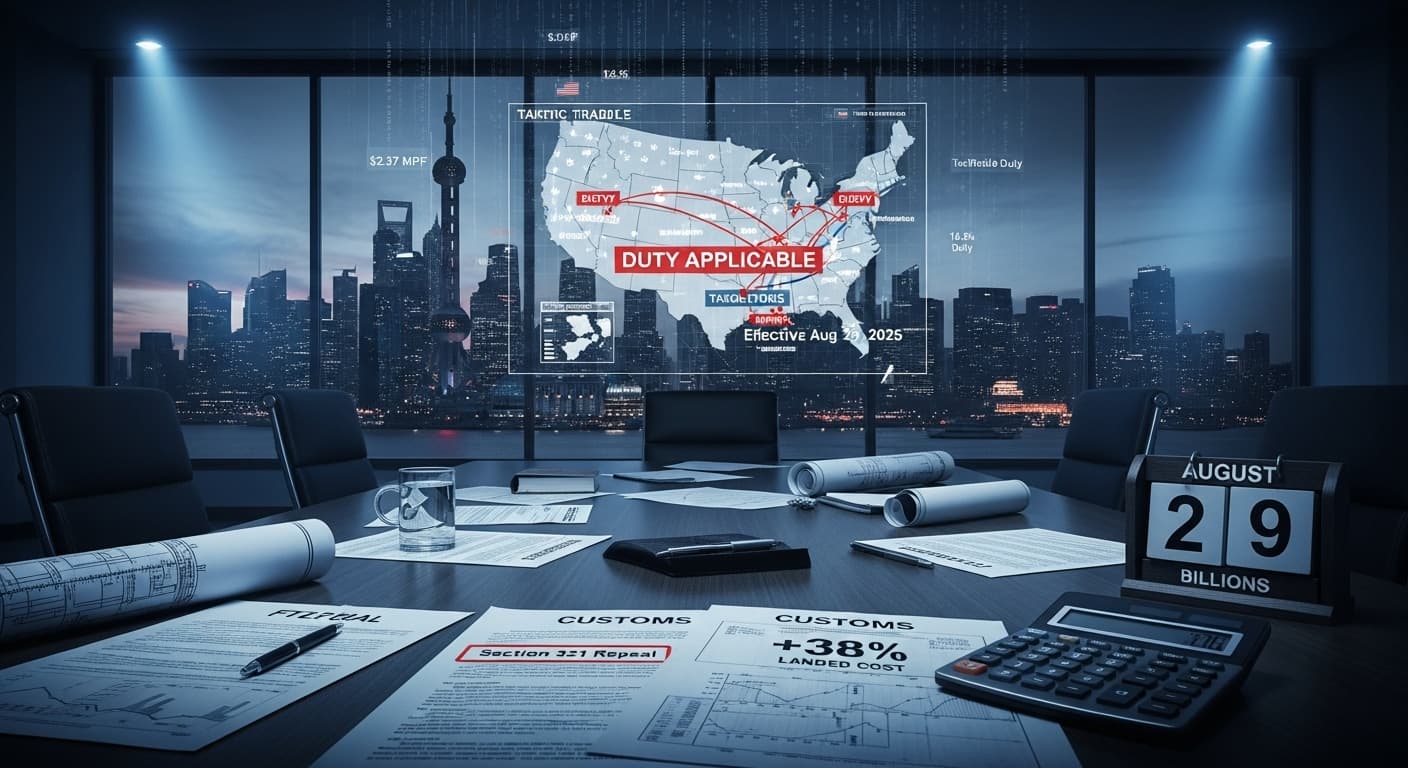

From 29 August 2025, every commercial package that enters the United States outside the postal system—no matter how small—will incur duties and fees. If your business model relies on duty-free $800 shipments, you need a new playbook before Labor Day. This comprehensive guide provides actionable strategies, cost analysis, and industry insights to help your business adapt and thrive.

Section 321 Repeal Takes Effect 29 August 2025 — What U.S.–China Shippers Must Do Now

(Section 321 免税撤销即将生效——美中贸易商当下必须采取的行动)

1 · Understanding the Seismic Shift in U.S. Trade Policy

The elimination of Section 321’s de minimis exemption represents the most significant change to U.S. import regulations in over two decades. This policy shift affects not just individual transactions, but the entire ecosystem of cross-border e-commerce, small business importation, and last-mile logistics.

What Exactly Is Changing?

- Executive Order (February 2025) suspended Section 321’s $800 de minimis privilege; the nationwide rollout date is 29 August 2025.

- Only USPS inbound mail keeps simplified paperwork, but even there ad-valorem or specific duties ($80–$200) now apply by origin country.

- CBP’s ACE system begins hard enforcement in production on 12 August 2025, ending the “warning-only” period.

| Date | Milestone | Impact | Industry Response |

|---|---|---|---|

| 1 Feb 2025 | Executive Order signed | Immediate suspension for China & Hong Kong air parcels | Major carriers begin system updates |

| 4 Feb 2025 | Pilot suspension starts | Selected ports & air carriers affected | 3PLs develop alternative routing |

| 12 Aug 2025 | ACE hard-code | CBP stops releasing Section 321 holds | Final testing of new processes |

| 29 Aug 2025 | Nationwide repeal | All transport modes except USPS affected | Full industry compliance required |

The Historical Context

The de minimis threshold has been a cornerstone of U.S. trade facilitation since the Trade Facilitation and Trade Enforcement Act of 2015 raised it from $200 to $800. This change enabled the explosive growth of direct-to-consumer shipping from Asia, particularly China, where platforms like AliExpress, Temu, and Shein built business models around duty-free small shipments.

Key Statistics:

- In 2019, approximately 1.8 billion packages entered the U.S. under Section 321

- By 2024, this number exceeded 4.2 billion packages annually

- China accounted for roughly 60% of all de minimis shipments

- The estimated revenue loss to the U.S. Treasury: $3.2 billion annually

2 · Industry Impact Analysis — Beyond the Numbers

E-commerce Transformation

The repeal fundamentally alters the economics of cross-border e-commerce. Businesses that thrived on the ability to ship individual items duty-free must now reconsider their entire operational model.

Affected Business Models:

- Dropshipping operations shipping directly from China to U.S. consumers

- Small importers bringing in samples, prototypes, or limited quantities

- Subscription box services sourcing diverse, low-value items internationally

- B2B spare parts suppliers shipping critical components on demand

Supply Chain Consolidation Trend

Industry experts predict a significant consolidation in the supply chain, with smaller players either adapting or exiting the market. This creates opportunities for established logistics providers to offer comprehensive solutions.

“We’re seeing a flight to quality in logistics partnerships. Companies that previously handled customs themselves are now seeking professional guidance,” says Sarah Chen, Director of Trade Compliance at a major 3PL provider.

3 · Cost Impact Analysis — Real-World Scenarios

Understanding the true cost impact requires examining various product categories and shipping patterns. Here are detailed scenarios across different industries:

Scenario 1: Apparel & Fashion

Item: $18 cotton T-shirt, Shenzhen → Los Angeles

| Cost Element | Before 29 Aug | After 29 Aug | Impact |

|---|---|---|---|

| Base price (CIF) | $18.00 | $18.00 | - |

| Duty (16.5% textile) | $0.00 | $2.97 | +$2.97 |

| Customs user fee (MPF – minimum) | $0.00 | $2.37 | +$2.37 |

| Broker / 3PL filing fee | $0.00 | $1.50 | +$1.50 |

| Total Landed Cost | $18.00 | $24.84 | +38% |

Scenario 2: Electronics & Components

Item: $45 smartphone case, Guangzhou → New York

| Cost Element | Before 29 Aug | After 29 Aug | Impact |

|---|---|---|---|

| Base price (CIF) | $45.00 | $45.00 | - |

| Duty (5.3% electronics) | $0.00 | $2.39 | +$2.39 |

| Customs user fee (MPF) | $0.00 | $2.37 | +$2.37 |

| Broker / 3PL filing fee | $0.00 | $1.50 | +$1.50 |

| Total Landed Cost | $45.00 | $51.26 | +14% |

Scenario 3: Health & Beauty Products

Item: $25 skincare serum, Shanghai → Miami

| Cost Element | Before 29 Aug | After 29 Aug | Impact |

|---|---|---|---|

| Base price (CIF) | $25.00 | $25.00 | - |

| Duty (0% - many cosmetics) | $0.00 | $0.00 | - |

| Customs user fee (MPF) | $0.00 | $2.37 | +$2.37 |

| Broker / 3PL filing fee | $0.00 | $1.50 | +$1.50 |

| Total Landed Cost | $25.00 | $28.87 | +15% |

Volume Impact Considerations

The cost impact becomes more complex when considering shipping volume patterns:

Low-Volume Shippers (1-50 packages/month):

- Highest per-unit impact due to minimum fees

- Limited negotiating power with service providers

- May need to exit certain product categories

Medium-Volume Shippers (51-500 packages/month):

- Opportunity to negotiate better broker rates

- Can leverage consolidation strategies

- Investment in compliance technology becomes viable

High-Volume Shippers (500+ packages/month):

- Best positioned to absorb costs through economies of scale

- Can justify investment in FTZ operations

- May gain competitive advantage as smaller competitors exit

4 · Comprehensive Compliance Strategies

Strategy 1: Type 86 “Simplified” Entry Process

Best for: Established importers with predictable product mix and moderate volumes

How it works:

- Automated customs entry for shipments under $800

- Duties and fees still apply, but processing is streamlined

- Faster clearance than formal entries

Limitations post-August 29:

- China-origin goods will be excluded from Type 86 processing

- Still requires accurate HTSUS classification

- Fees and duties cannot be avoided

Implementation Steps:

- Register with CBP for Type 86 privileges

- Establish electronic data interchange (EDI) capabilities

- Train staff on proper commodity classification

- Set up duty and fee accounting systems

Strategy 2: Foreign-Trade Zone (FTZ) Operations

Best for: High-volume importers, 3PLs, and businesses with inventory staging needs

Advantages:

- Duty deferral: Pay duties only when goods leave the FTZ for U.S. consumption

- Duty reduction: Potential for inverted tariff benefits on manufactured goods

- Inventory management: Store goods indefinitely without paying duties

- Processing capabilities: Perform light manufacturing and repackaging

Cost Structure:

- FTZ activation fee: $15,000-$25,000

- Monthly rent: $0.50-$1.50 per square foot

- Weekly entry fees: $125-$250 per customs entry

- Zone operator fees: Variable based on services

Case Study: Electronics Distributor A California-based electronics distributor implemented FTZ operations in 2024, anticipating the Section 321 repeal:

- Before FTZ: $2.2M annual duty payments on imported inventory

- After FTZ: $1.6M annual duty payments (27% reduction)

- Additional benefits: Improved cash flow, reduced obsolete inventory risk

- Payback period: 14 months

Strategy 3: Zone-Skipping and Mail Injection

Best for: Direct-to-consumer brands with geographically dispersed customer base

Process Overview:

- Import goods in bulk via formal entry or FTZ

- Consolidate customer orders at regional distribution centers

- “Zone-skip” palletized orders to destination postal facilities

- Final delivery via USPS domestic network

Benefits:

- Maintain competitive delivery times

- Leverage USPS’s extensive last-mile network

- Reduce per-package shipping costs

- Spread customs compliance costs across multiple orders

Challenges:

- Requires sophisticated inventory forecasting

- Higher working capital requirements

- Dependence on USPS service levels

- Complex reverse logistics for returns

Strategy 4: Nearshoring and Supply Chain Redesign

Best for: Companies with flexibility in sourcing locations

The Section 321 repeal is accelerating existing nearshoring trends, with companies relocating production or establishing distribution hubs closer to the U.S. market.

Nearshoring Destinations:

- Mexico: Leverages USMCA free trade benefits, proximity to U.S. markets

- Costa Rica: Established electronics and medical device manufacturing

- Dominican Republic: Strong textile and apparel sector under CAFTA-DR

- Canada: Seamless integration with U.S. logistics networks

Hybrid Approach Example: A consumer electronics company restructured its supply chain:

- High-volume items: Direct import from China to FTZ facilities

- Fast-moving accessories: Production in Mexico under USMCA

- Customized products: Assembly in Texas from imported components

5 · Technology Solutions and Digital Transformation

Customs Management Systems

The complexity of post-Section 321 compliance is driving adoption of sophisticated customs management technologies:

Key Features to Look For:

- Automated HTSUS classification using AI and machine learning

- Duty optimization engines that calculate lowest-cost import methods

- Real-time duty and fee calculations for pricing decisions

- Compliance monitoring with automated alerts for regulatory changes

- Integration capabilities with ERP, WMS, and e-commerce platforms

Data Analytics for Cost Optimization

Advanced analytics help companies make informed decisions about product mix, pricing, and sourcing:

Analytical Capabilities:

- Landed cost modeling across different import strategies

- Duty impact analysis by product category and origin

- Customer sensitivity analysis for price increases

- Optimal inventory positioning to minimize duty exposure

Blockchain for Supply Chain Transparency

Some forward-thinking companies are implementing blockchain solutions to ensure compliance and optimize duty treatment:

Applications:

- Origin verification: Ensuring accurate country-of-origin declarations

- Supply chain traceability: Supporting preferential duty claims

- Audit trails: Maintaining comprehensive records for CBP examinations

6 · Eight-Point Implementation Checklist

Planning Considerations for Implementation

Understanding the requirements and implications of each compliance strategy helps businesses evaluate their options and develop appropriate implementation plans.

Comprehensive Analysis Framework

Cost Impact Assessment:

- Classify every product under HTSUS to understand duty implications

- Calculate total landed costs including all fees and handling charges

- Identify products that may become uneconomical under new cost structures

- Model alternative sourcing strategies for affected items

Operational Requirements Analysis:

- Map current shipping patterns and consolidation opportunities

- Assess technology infrastructure needs for compliance management

- Evaluate service provider capabilities for new requirements

- Determine staff training and expertise development needs

Strategic Implementation Planning:

- Test various import methods through pilot shipments

- Develop customer communication strategies for service changes

- Create performance monitoring systems for key metrics

- Establish processes for ongoing regulatory compliance

Technology Infrastructure Considerations

Modern compliance management requires sophisticated technology solutions that can handle the complexity of post-Section 321 requirements:

Core System Capabilities:

- Automated HTSUS classification with machine learning capabilities

- Real-time duty and fee calculations for pricing decisions

- Integration with ERP, WMS, and e-commerce platforms

- Compliance monitoring with automated regulatory alerts

Data Analytics for Optimization:

- Landed cost modeling across different import strategies

- Duty impact analysis by product category and origin country

- Customer price sensitivity analysis for strategic pricing

- Optimal inventory positioning to minimize duty exposure

6 · Industry Case Studies and Adaptation Strategies

Case Study 1: “NovaStyle” Fast-Fashion Transformation

Company Profile: Mid-size fast-fashion retailer, $50M annual revenue, 80% of inventory from China

Challenge: Section 321 repeal threatened 40% margin erosion on key product categories

Solution Implementation:

- Phase 1 (March 2025): Established FTZ operations in Ontario, CA

- Phase 2 (May 2025): Implemented zone-skipping to 12 regional USPS hubs

- Phase 3 (July 2025): Launched subscription service to increase order values

Results:

- Duty burden reduced by 35% through FTZ utilization

- Delivery times maintained: West Coast 2-3 days, East Coast 4-5 days

- Gross margin impact limited to 9% vs. projected 40%

- Customer retention rate: 94% despite price increases

Key Success Factors:

- Early preparation and testing

- Investment in inventory forecasting technology

- Strategic customer communication about value proposition

Case Study 2: “TechConnect” B2B Component Supplier

Company Profile: Industrial component distributor, focus on urgent replacement parts

Challenge: Customers required same-day or next-day delivery for critical components

Solution:

- Established distributed inventory network using FTZ warehouses

- Implemented automated customs management system

- Developed tiered pricing model based on urgency

Results:

- Maintained 95% of urgent delivery commitments

- Increased average order values by 180%

- Improved inventory turnover from 6x to 9x annually

- Customer satisfaction scores increased despite higher prices

Case Study 3: “Global Beauty Co.” Cosmetics Brand

Company Profile: Direct-to-consumer beauty brand, premium positioning

Unique Advantage: Most cosmetics enter duty-free, minimizing tariff impact

Strategy:

- Leveraged duty-free status for competitive advantage

- Invested savings from lower duty burden into enhanced packaging and logistics

- Accelerated direct-to-consumer channel expansion

Results:

- Market share increased 23% as competitors struggled with duty costs

- Customer acquisition costs decreased 15% due to improved value proposition

- Established leadership position in premium segment

7 · Understanding Future Industry Trends

The Rise of Regional Distribution Networks

The Section 321 repeal is accelerating the development of regional distribution networks, with companies establishing multiple smaller fulfillment centers rather than relying on single large facilities.

Key Trends:

- Micro-fulfillment centers in major metropolitan areas

- Cross-docking facilities for rapid inventory turnover

- Shared logistics networks among complementary brands

- Automated sorting and packing to reduce labor costs

Evolving Carrier Services

Major shipping carriers are adapting their service offerings to address post-Section 321 challenges:

New Service Categories:

- Consolidated customs clearance for multiple small shipments

- Duty-inclusive pricing with transparent fee structures

- Enhanced tracking with customs status visibility

- Expedited clearance programs for qualified shippers

Regulatory Evolution

Industry experts anticipate continued regulatory evolution in response to implementation challenges:

Potential Future Changes:

- Revised duty rates for specific product categories

- Enhanced enforcement of existing trade remedy orders

- New compliance requirements for e-commerce platforms

- Bilateral trade negotiations affecting duty treatment

Technology Innovation

The complexity of post-Section 321 compliance is spurring innovation in logistics technology:

Emerging Technologies:

- AI-powered classification systems with 99%+ accuracy rates

- Predictive analytics for duty optimization

- Automated compliance monitoring with real-time alerts

- Integrated supply chain platforms combining multiple service providers

8 · Comprehensive FAQ and Industry Insights

General Questions

Q1: Will USPS parcels still be duty-free?

A: No. Postal shipments retain simplified paperwork but now attract either ad-valorem rates or the new $80–$200 specific tariff by country. However, the administrative burden remains lower than commercial imports.

Q2: Does the exemption still apply to Canada, EU, or Mexico origins?

A: Only until 29 August 2025. After that date, all non-postal origins are dutiable with no country carve-outs currently planned.

Q3: How does CBP track multiple low-value parcels to the same consignee?

A: CBP’s ACE system aggregates shipments by name, address, and tax ID in real time. When combined shipments exceed $800, all packages may be subject to formal entry requirements.

Business Strategy Questions

Q4: Should we increase our minimum order values to offset the additional costs?

A: This is a common strategy, but consider customer price sensitivity. Our analysis suggests that gradual increases (10-15% initially) with clear value communication work better than dramatic price jumps.

Q5: Is it worth investing in FTZ operations for smaller importers?

A: Generally, FTZ operations become cost-effective for importers with annual duty liabilities exceeding $200,000. Smaller importers should consider shared FTZ services offered by 3PLs.

Q6: How do we explain these changes to our customers?

A: Transparency is key. Provide clear information about the regulatory changes, emphasize your commitment to service continuity, and highlight any investments you’re making to minimize impact.

Operational Questions

Q7: What happens to shipments in transit on August 29?

A: CBP has indicated that shipments that departed origin before August 29 may still qualify for Section 321 treatment if they arrive before September 15, 2025. However, this grace period is not guaranteed.

Q8: Can we use multiple consignees to stay under the $800 threshold?

A: No. CBP actively monitors for artificial consignee arrangements and imposes severe penalties for abuse. All shipments must be consigned to their true ultimate consignee.

Q9: How do returns and exchanges work under the new rules?

A: Returns of defective or incorrect merchandise can often be reimported without additional duty under specific CBP procedures. However, documentation requirements are more stringent than under Section 321.

9 · Strategic Considerations and Key Insights

Strategic Planning Considerations

- Cost Impact Assessment - Understanding the full financial implications across all product lines and customer segments

- Service Provider Evaluation - Assessing capabilities of customs brokers and 3PLs for new requirements

- Technology Infrastructure - Evaluating systems needed for customs management and cost optimization

- Customer Communication Strategy - Developing transparent communication about regulatory changes

Operational Adaptation Areas

- Product Portfolio Optimization - Analyzing which products remain viable under new cost structures

- Sourcing Strategy Diversification - Exploring alternative supply sources including nearshoring options

- Inventory Management Enhancement - Building capabilities to support consolidation and bulk importation

- Compliance Capability Development - Establishing internal expertise for regulatory navigation

Long-Term Strategic Positioning

- Competitive Differentiation - Building advantages through superior logistics execution

- Partnership Strategy - Developing strategic relationships with suppliers and service providers

- Technology Leverage - Utilizing advanced systems for continuous optimization

- Regulatory Monitoring - Maintaining awareness of evolving trade policies and requirements

Final Thoughts

The Section 321 repeal represents a fundamental shift in the U.S. trade landscape that affects companies across all industries engaged in international commerce. While the immediate operational and cost implications are significant, understanding these changes and their broader context is essential for making informed business decisions.

The regulatory environment will continue to evolve, and companies that stay informed about developments in trade policy, technology solutions, and industry best practices will be better positioned to navigate future changes. This transformation also highlights the importance of building resilient supply chains that can adapt to regulatory shifts while maintaining operational efficiency and customer service standards.

Success in this new environment requires a combination of strategic thinking, operational excellence, and continuous learning. Companies that approach these challenges with a focus on long-term sustainability rather than short-term fixes will likely emerge stronger and more competitive.

The logistics industry has historically demonstrated remarkable adaptability in the face of regulatory changes, and the Section 321 repeal, while significant, is another evolution that the industry will successfully navigate through innovation, collaboration, and strategic planning.

This analysis is provided for informational purposes to help businesses understand the implications of regulatory changes in international trade. Advanced Logistics Solutions offers comprehensive logistics and trade compliance consulting services for companies navigating complex regulatory environments. For additional insights or to discuss how these changes might affect your specific situation, we welcome the opportunity to share our expertise.